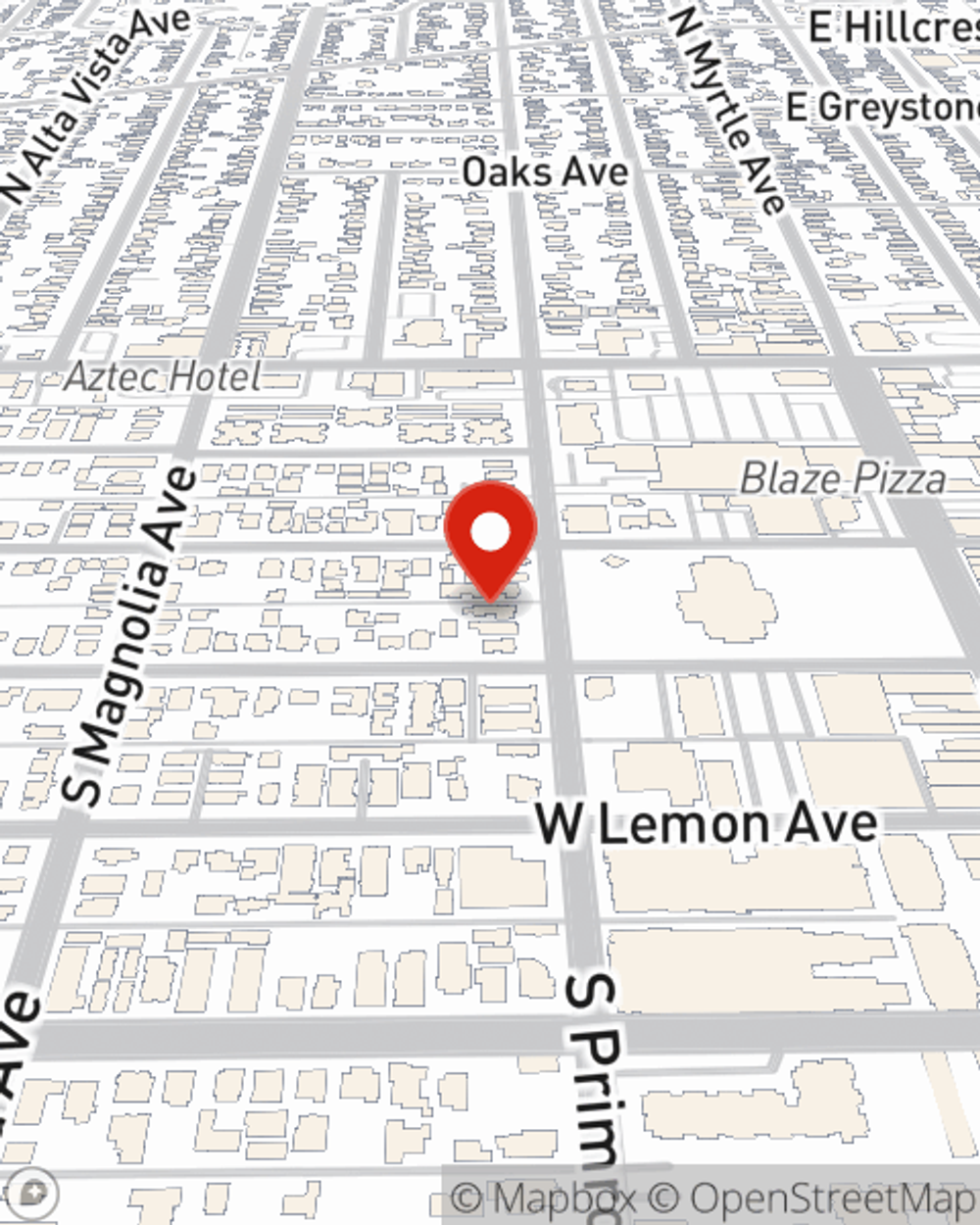

Business Insurance in and around Monrovia

One of Monrovia’s top choices for small business insurance.

Insure your business, intentionally

Cost Effective Insurance For Your Business.

Running a business can be risky. It's always better to be prepared for the unfortunate accident, like a customer hurting themselves on your business's property.

One of Monrovia’s top choices for small business insurance.

Insure your business, intentionally

Keep Your Business Secure

With State Farm small business insurance, you can give yourself more protection! State Farm agent Regina Talbot is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Regina Talbot can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let the unknown about your business keep you up at night! Get in touch with State Farm agent Regina Talbot today, and learn more about how you can meet your needs with State Farm small business insurance.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Regina Talbot

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?